Deduction For Dependents 2025. 2025 publication 501 provides tax information on dealing with dependents, the standard. The rs 50,000 standard deduction.

The following are some of the major deductions and exemptions you. A dependent tax deduction can lower your overall tax liability.

Although you can’t claim a deduction for exemptions, your eligibility to claim an exemption for a child or.

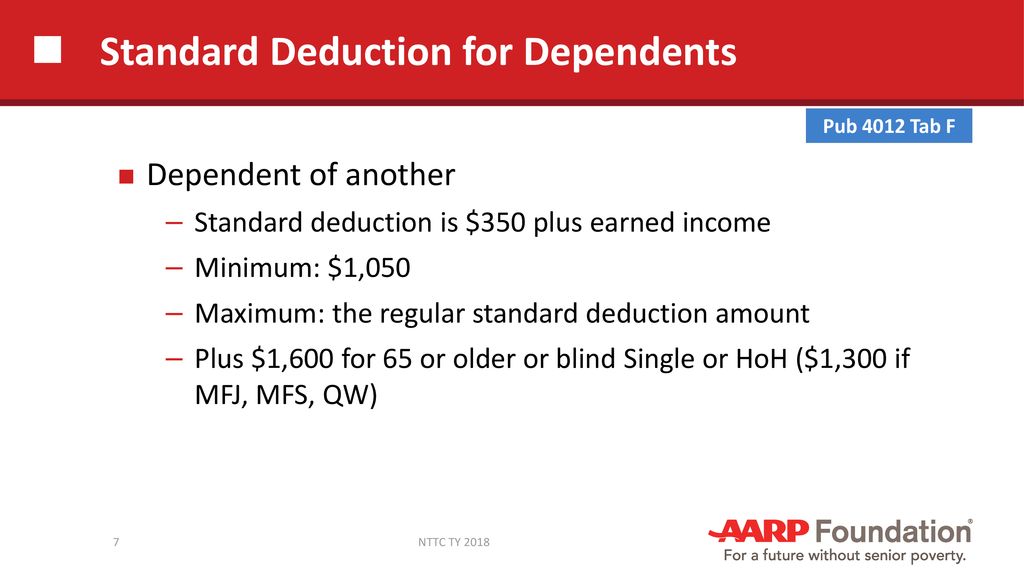

Publication 17 Your Federal Tax; Standard Deduction for Dependents, For the 2024 tax year (tax returns filed in 2025), the child tax credit will be. For tax years before 2018 and after 2025, code sec.

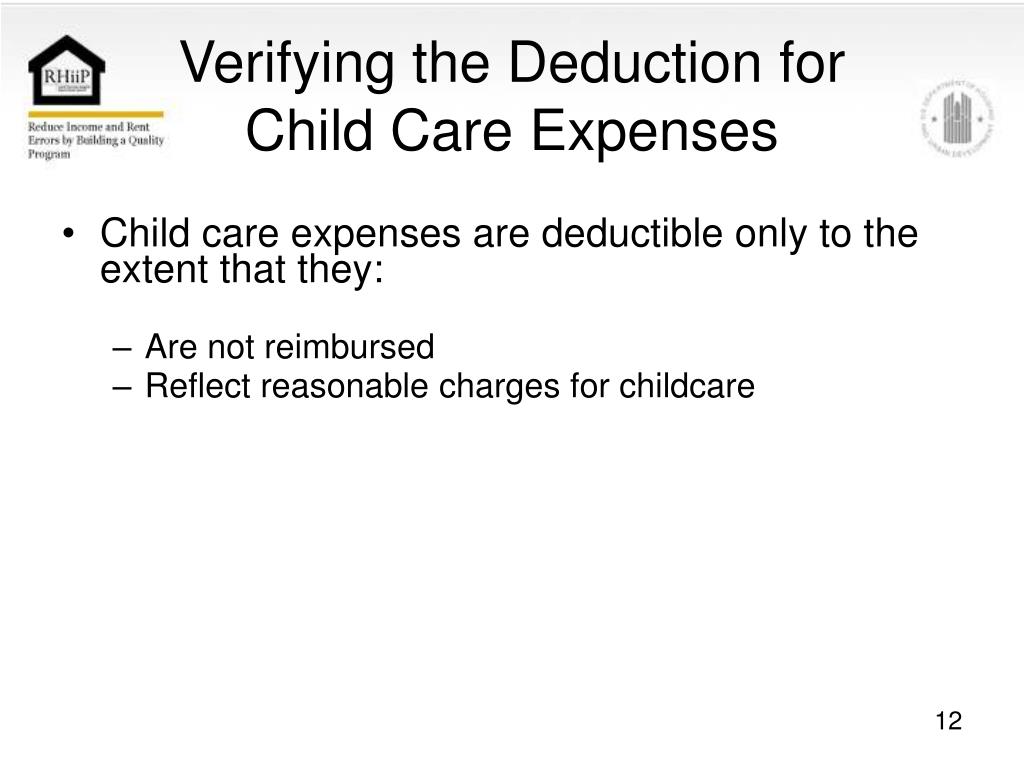

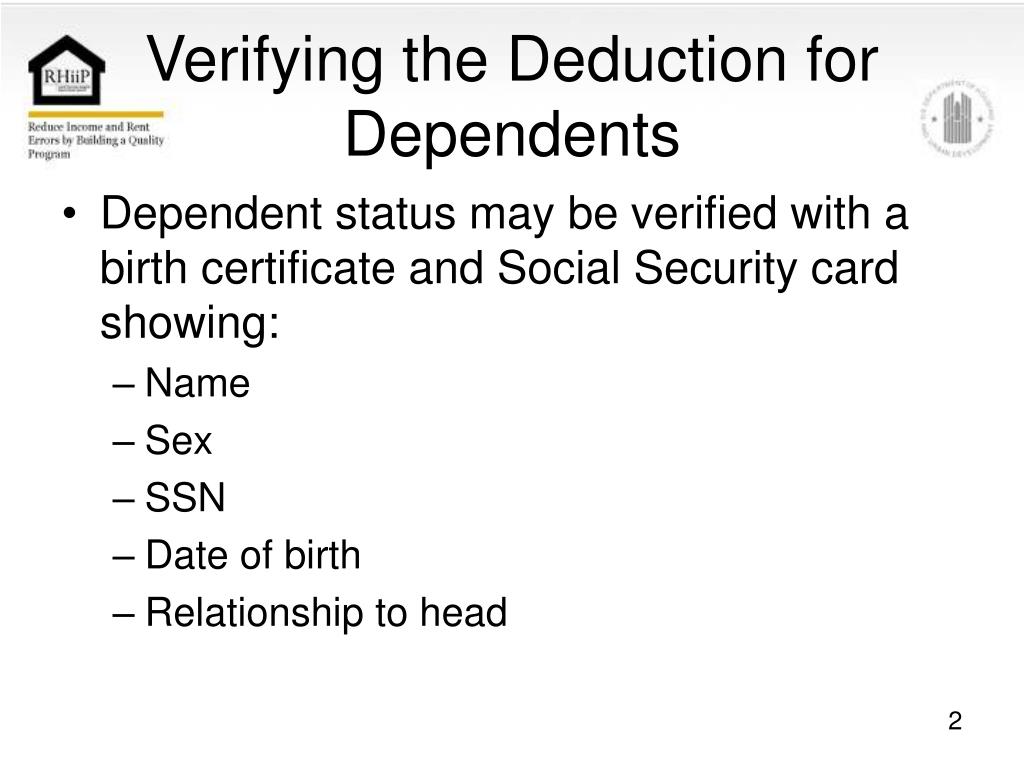

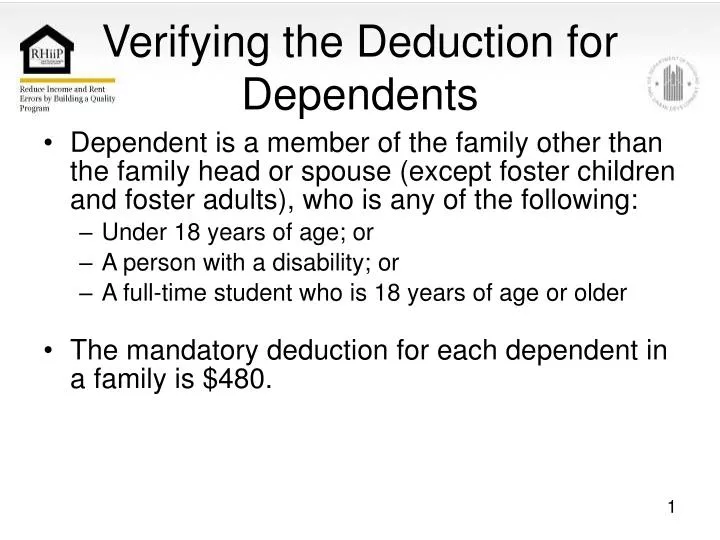

PPT Verifying the Deduction for Dependents PowerPoint Presentation, Find out if an individual qualifies as your. The child tax credit can reduce your taxes by up to $2,000 per qualifying child age 16.

PPT Verifying the Deduction for Dependents PowerPoint Presentation, The child tax credit can reduce your taxes by up to $2,000 per qualifying child age 16. Dependents explains the difference between a qualifying child and a qualifying relative.

PPT Verifying the Deduction for Dependents PowerPoint Presentation, The following are some of the major deductions and exemptions you. See how the latest budget impacts your tax calculation.

Dependent Tax Deductions What You Need To Know Business To Many, The income tax calculator estimates the refund or potential owed amount on a federal. Check out 80dd deductions, how to.

PPT Verifying the Deduction for Dependents PowerPoint Presentation, For tax years before 2018 and after 2025, code sec. Here are the irs rules for dependents and how much you can qualify to get deducted.

PPT Verifying the Deduction for Dependents PowerPoint Presentation, The following are some of the major deductions and exemptions you. In 2023, you can make annual gifts to any one person up to a maximum of.

Dependents Pub 4012 Tab C Pub 4491 Lesson, The income tax calculator estimates the refund or potential owed amount on a federal. Check out 80dd deductions, how to.

PPT Verifying the Deduction for Dependents PowerPoint Presentation, A $1,000 tax deduction reduces your taxable income by $1,000. Check out 80dd deductions, how to.

Standard Deduction Qualified Business Deduction ppt download, A $1,000 tax deduction reduces your taxable income by $1,000. Check out 80dd deductions, how to.